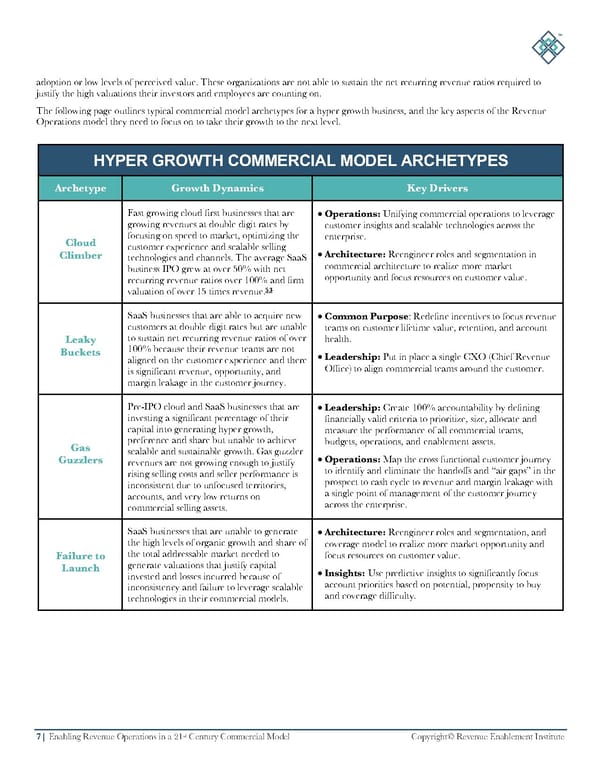

7 | Enabling Revenue Operations in a 21 st Century Commercial Model Copyright © Revenue Enablement Institute adoption or low levels of perceived value. These organizations are not able to sustain the net recurring revenue ratios requi red to justify the high valuations their investors and employees are counting on. The following page outlines typical commercial model archetypes for a hyper growth business, and the key aspects of the Revenue Operations model they need to focus on to take their growth to the next level. HYPER GROWTH COMMERCIAL MODEL ARCHETYPES Archetype Growth Dynamics Key Drivers Cloud Climber Fast growing cloud first businesses that are growing revenues at double digit rates by focusing on speed to market, optimizing the customer experience and scalable selling technologies and channels. The average SaaS business IPO grew at over 50% with net recurring revenue ratios over 100% and firm valuation of over 15 times revenue. 53 • Operations : Unifying commercial operations to leverage customer insights and scalable technologies across the enterprise. • Architecture: Reengineer roles and segmentation in commercial architecture to realize more market opportunity and focus resources on customer va lue. Leaky Buckets SaaS businesses that are able to acquire new customers at double digit rates but are unable to sustain net recurring revenue ratios of over 100% because their revenue teams are not aligned on the customer experience and there is significant revenue, opportunity, and margin leakage in the customer journey. • Common P urpose : Redefine incentives to focus revenue teams on customer lifetime value, retention, and account health. • Leadership: Put in place a single CXO (Chief Revenue Office ) to align commercial teams around the customer. Gas Guzzlers Pre - IPO cloud and SaaS businesses that are investing a significant percentage of their capital into generating hyper growth, preference and share but unable to achieve scalable and sustainable growth. Gas guzzler revenues are not growing enough to justify rising selling costs and seller performance is inconsistent due to unfocused territories, accounts, and very low returns on commercial selling assets. • Leadership: Create 100% accountability by defining financially valid criteria to prioritize, size, allocate and measure the performance of all commercial teams, budgets, operations, and enablement assets. • Operations: Map the cross functional customer journey to ident ify and eliminate the handoffs and “air gaps” in the prospect to cash cycle to revenue and margin leakage with a single point of management of the customer journey across the enterprise. Failure t o Launch SaaS businesses that are unable to generate the hi gh levels of organic growth and share of the total addressable market needed to generate valuations that justify capital invested and losses incurred because of inconsistency and failure to leverage scalable technologies in their commercial models. • Archite cture: Reengineer roles and segmentation, and coverage model to realize more market opportunity and focus resources on customer value. • Insights: Use predictive insights to significantly focus account priorities based on potential, propensity to buy and cov erage difficulty.

How Rev Ops Can Grow Your Business Page 6 Page 8

How Rev Ops Can Grow Your Business Page 6 Page 8