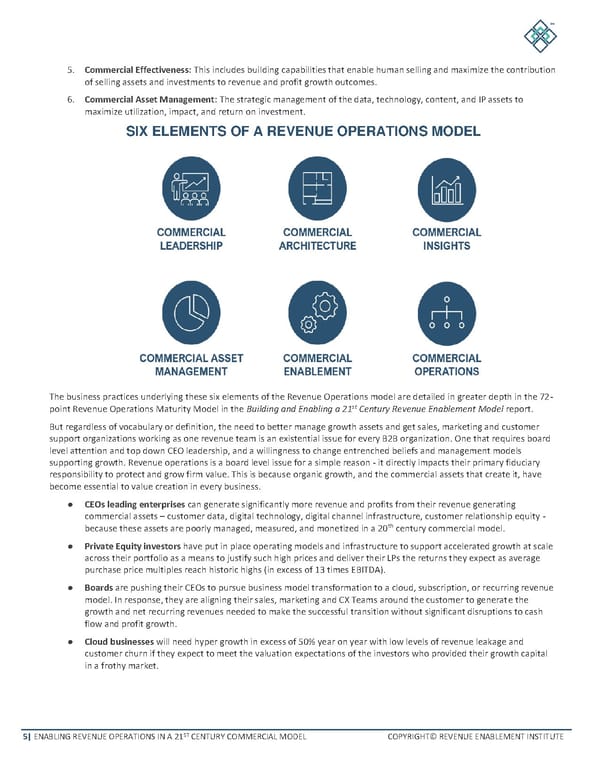

5 | ENABLING REVENUE OPERATIONS IN A 21 ST CENTURY COMMERCIAL MODEL COPYRIGHT © REVENUE ENABLEMENT INSTITUT E 5. Commercial Effectiveness: This includes building capabilities that enable human selling and maximize the contribution of selling assets and investments to revenue and profit growth outcomes. 6. Co mmercial Asset Management: The strategic management of the data, technology, content, and IP assets to maximize utilization, impact, and return on investment. SIX ELEMENTS OF A REVENUE OPERATIONS MODEL The business practices underlying these six elements of the Revenue Operations model are detailed in greater depth in the 72 - point Revenue Operations Maturity Model in the Building and Enabling a 21 st Century Revenue Enablement Model report. But regardles s of vocabulary or definition, the need to better manage growth assets and get sales, marketing and customer support organizations working as one revenue team is an existential issue for every B2B organization. One that requires board level attention and t op down CEO leadership, and a willingness to change entrenched beliefs and management models supporting growth. Revenue operations is a board level issue for a simple reason - it directly impacts their primary fiduciary responsibility to protect and grow f irm value. This is because organic growth, and the commercial assets that create it, have become essential to value creation in every business. ● CEOs leading enterprises can generate significantly more revenue and profits from their revenue generating comme rcial assets – customer data, digital technology, digital channel infrastructure, customer relationship equity - because these assets are poorly managed, measured, and monetized in a 20 th century commercial model. ● Private Equity investors have put in place operating models and infrastructure to support accelerated growth at scale across their portfolio as a means to justify such high prices and deliver their LPs the returns they expect as average purchase price multiples reach historic hig hs (in excess of 13 times EBITDA). ● Boards are pushing their CEOs to pursue business model transformation to a cloud, subscription, or recurring revenue model. In response, they are aligning their sales, marketing and CX Teams around the customer to generat e the growth and net recurring revenues needed to make the successful transition without significant disruptions to cash flow and profit growth. ● Cloud businesses will need hyper growth in excess of 50% year on year with low levels of revenue leakage and cu stomer churn if they expect to meet the valuation expectations of the investors who provided their growth capital in a frothy market.

Executive Summary Page 4 Page 6

Executive Summary Page 4 Page 6